Portions of this article were created with assistance from AI tools to help with research, drafting, or copy editing. A human editor reviewed the work, verified key facts, and approved the final version.

AI-assisted content

Spirit Airlines, a prominent American low-cost carrier, has faced significant turbulence, leading to its decision to cancel a massive order for Airbus aircraft.

After filing for bankruptcy, the airline's financial stability has been in question, forcing management to reevaluate its commitments, including the substantial order for 52 A320neo planes. The bankruptcy was partly triggered by mounting debt, the COVID-19 pandemic's effect on travel demand, and rising operational costs, all contributing to a dire financial landscape for the airline.

As part of its Chapter 11 proceedings, Spirit reached a critical settlement with AerCap, the leasing company that holds its aircraft leases. This agreement is seen as a crucial turning point for Spirit, not only aiding in its immediate financial recovery but also in establishing a clearer path toward stability and restructuring.

The cancellation of the Airbus order is an indicator of the stark realities Spirit faces in maintaining operational flexibility and addressing financial obligations during this uncertain period.

The importance of this bankruptcy settlement lies in its potential to reshape Spirit Airlines' future and the wider aviation landscape. It underscores the ongoing challenges that low-cost carriers face in the current market, as they balance growth aspirations with the need for financial prudence.

The settlement with AerCap may enable the airline to streamline operations and emerge from bankruptcy in a more competitive position, yet it carries the inherent risk of reduced fleet capacity in the near term.

Spirit's Agreement with AerCap

The financial implications of the settlement between Spirit Airlines and AerCap are multifaceted and vital for the airline's recovery. Central to the agreement is a considerable cash injection that will help Spirit shore up its finances amidst the ongoing bankruptcy proceedings. This capital will provide much-needed liquidity, allowing the airline to manage day-to-day operations and focus on strategic decisions moving forward.

In addition to the cash injection, the settlement includes provisions regarding unsecured claims and lease agreements. The cancellation of the Airbus orders directly affects these leases, representing a significant adjustment in Spirit's long-term financial obligations. By renegotiating lease conditions and eliminating large aircraft orders, Spirit aims to reduce its financial burden and prioritize operational sustainability.

Ad by Jetstream Magazine by AeroXplorer.

Ad by Jetstream Magazine by AeroXplorer.

This restructuring of agreements highlights the importance of maintaining favorable terms with lessors like AerCap, particularly during tumultuous periods. As airlines navigate financial challenges, having a flexible leasing structure can be a lifeline. The implications of this agreement extend beyond Spirit Airlines, serving as a bellwether for how the airline industry is adapting to a post-pandemic reality where fiscal discipline is paramount.

The Decision to Forfeit Aircraft Orders

Spirit Airlines' strategic decision to forfeit its commitment to purchase 52 Airbus planes stems from a combination of financial necessity and operational strategy. This pivotal move aligns with the airline's need to resize its fleet in response to changing market conditions and financial pressures. By canceling these orders, Spirit is acknowledging the constraints of its current operational capacity, which is a pragmatic approach to safeguarding the airline's future.

One of the central reasons for this decision lies in the need to modernize its fleet in a more sustainable manner. With the cancellation of the Airbus orders, Spirit can instead focus on optimizing its existing fleet's efficiency and cutting costs, particularly in an environment where cost management is critical for survival. While the loss of new aircraft might limit growth prospects in the short term, it allows the airline to strengthen its operational framework during a period of financial redistribution.

The impact of this choice extends into operational capabilities. By not adding more aircraft, Spirit Airlines may face challenges in scaling its operations and meeting customer demand effectively. However, this sacrifice may prove beneficial in the long run, as it gives the airline a chance to regroup and position itself effectively in a highly competitive low-cost airline market.

Financial Analysis: Spirit Airlines’ Future Prospects

As Spirit Airlines embarks on a challenging journey towards recovery, the long-term financial consequences of its recent settlement and operational adjustments remain a focal point. The settlement with AerCap signifies a crucial step in stabilizing the airline’s finances, yet it is accompanied by inherent risks associated with reduced fleet and operational capacity. Moving forward, Spirit must navigate these complexities while striving to regain competitiveness in a reshaped aviation market.

Ad by Jetstream Magazine by AeroXplorer.

Ad by Jetstream Magazine by AeroXplorer.

Spirit faces potential challenges, including fluctuating demand for travel, operational costs that may continue to escalate, and the difficulty of innovating its service model in the face of these constraints. However, there exist opportunities as well; as travel demand rebounds, low-cost carriers like Spirit may find appealing niches in a market hungry for affordability and efficiency.

Ultimately, the path that Spirit Airlines charts ahead will demand astute financial management and a reconfiguration of its business strategies. Only by understanding the implications of this settlement and actively working to address operational challenges can Spirit aim to secure its place as a viable player in the airline industry once again.

Industry Reactions and Broader Implications

Ad by Jetstream Magazine by AeroXplorer.

Ad by Jetstream Magazine by AeroXplorer.

The airline industry's reaction to Spirit Airlines' decision to cancel its Airbus order has been largely one of caution and reflection. Industry experts and analysts have expressed concern about the implications this decision might have on the overall health of low-cost carriers. The reevaluation of fleet expansion amidst financial pressures signals a broader trend that could influence how airlines operate in the near future.

Experts suggest that Spirit's struggles may serve as a case study for other airlines grappling with similar challenges in a post-pandemic environment. The general consensus among industry analysts is that Spirit’s decision represents a shift in priorities among airlines, where financial health takes precedence over expansion ambitions. This new approach may lead to a reevaluation of growth strategies, emphasizing financial robustness over fleet size.

Furthermore, the implications for aircraft leasing markets are significant. As airlines reconsider their long-term commitments to aircraft orders, lessors like AerCap may find greater leverage and the ability to dictate terms in a tighter market. This situation exemplifies the interconnected nature of the aviation industry, where decisions made by one player can reverberate across the sector, potentially altering trends for years to come.

The Path Ahead for Spirit Airlines

Looking forward, the necessity of adapting to financial pressures while maintaining competitiveness will define Spirit Airlines' journey post-settlement. The emphasis on restructuring and workforce adjustments indicates a deliberate effort to emerge from the current crisis more resilient. If successful, Spirit may pave the way for a renewed low-cost airline model in an industry eager for efficiency and fiscal prudence.

The airline’s future will depend on its capacity to balance short-term sacrifices against long-term gains, ultimately determining how it can recalibrate its operations and strategy in a continuously shifting aviation landscape.

How to Study Aerospace Engineering and Succeed as a University Student » Beijing's Boeing: What It's Like Onboard China's COMAC C919 » 13 Year Old Stowaway Found in the Landing Gear of Kabul-Delhi Flight »

Comments (0)

Add Your Comment

SHARE

TAGS

NEWS AI Spirit Airlines Airbus AerCap Bankruptcy Airline IndustryRECENTLY PUBLISHED

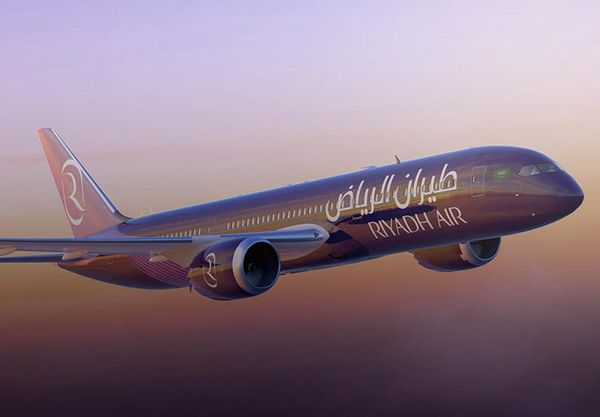

Riyadh Air to Launch Inaugural London-Heathrow Flight October 26

Riyadh Air, the Saudi Arabian national airline, will launch its first international flights to London’s Heathrow airport (LHR) starting 26th October. The first flights will be flown daily with one of the airline's Boeing 787-9 aircraft, Jamila, which is currently designated as a technical spare.

ROUTES

READ MORE »

Riyadh Air to Launch Inaugural London-Heathrow Flight October 26

Riyadh Air, the Saudi Arabian national airline, will launch its first international flights to London’s Heathrow airport (LHR) starting 26th October. The first flights will be flown daily with one of the airline's Boeing 787-9 aircraft, Jamila, which is currently designated as a technical spare.

ROUTES

READ MORE »

Beijing's Boeing: What It's Like Onboard China's COMAC C919

Aboard China's COMAC C919, I experienced more than just a flight; I witnessed China's ambition to challenge decades of Western dominance in the skies. Could China really build a world-class passenger jet?

TRIP REPORTS

READ MORE »

Beijing's Boeing: What It's Like Onboard China's COMAC C919

Aboard China's COMAC C919, I experienced more than just a flight; I witnessed China's ambition to challenge decades of Western dominance in the skies. Could China really build a world-class passenger jet?

TRIP REPORTS

READ MORE »

How to Study Aerospace Engineering and Succeed as a University Student

Learn how to study aerospace engineering effectively, manage your workload, and succeed as a student with practical strategies and expert guidance.

INFORMATIONAL

READ MORE »

How to Study Aerospace Engineering and Succeed as a University Student

Learn how to study aerospace engineering effectively, manage your workload, and succeed as a student with practical strategies and expert guidance.

INFORMATIONAL

READ MORE »